|

The China Factor

The black box of tapping into the Chinese market |

32nd Edition

Dear Clients & Friends:

Please review our 32nd edition of the China Factor Newsletter. With three months ahead to end this 2012, it is necessary for companies to be informed about several topics such as: economics, M&A, tax and legal frames, among others.

Please review our editorial comment: The black box of tapping into the Chinese market, and the Asia Pacific Economic Outlook — July 2012 , report that includes an overview of this region. Additionally, please review the weekly reports on M&A.

Don´t forget to register to the next Asia Pacific webcast: Strategic Transfer Pricing: A Framework for Effective Planning and Compliance.

We hope you find this information practical and useful to broaden your perspective about business related topics between Mexico and China.

Chinese Services Group

Deloitte Mexico

Versión en español Versión en español

In this edition:

Editorial comment

The black box of tapping into the Chinese market The black box of tapping into the Chinese market

Taking the helm of business in China

Global Economic Outlook - Q3 2012 Global Economic Outlook - Q3 2012

Procurement fraud and corruption Sourcing from Asia / 采購欺詐與腐敗 - 防患於未然 Procurement fraud and corruption Sourcing from Asia / 采購欺詐與腐敗 - 防患於未然

Hong Kong IPO Market. Interim Review and Outlook - 2012 / 香港IPO市场 2012年中期回顾与展望 Hong Kong IPO Market. Interim Review and Outlook - 2012 / 香港IPO市场 2012年中期回顾与展望

China VAT Reform - Timetable for expanded VAT reform pilot announced China VAT Reform - Timetable for expanded VAT reform pilot announced

China Mergers & Acquisitions Playbook China Mergers & Acquisitions Playbook

China M&A Round-up, 09-21-2012 China M&A Round-up, 09-21-2012

China M&A Round-up, 09-14-2012 China M&A Round-up, 09-14-2012

China M&A Round-up, 09-07-2012 China M&A Round-up, 09-07-2012

Publications

Asia Pacific Economic Outlook — July 2012 Asia Pacific Economic Outlook — July 2012

The China Factor: Doing Business in China The China Factor: Doing Business in China

Keeping pace

Upcoming webcasts Upcoming webcasts

|

Deloitte China mobile app: Get connected to our collective knowledge

and fresh insights on today's

complex market and business issues

while you are on the go. Click here to download. |

Editorial comment

The black box of tapping into the Chinese market

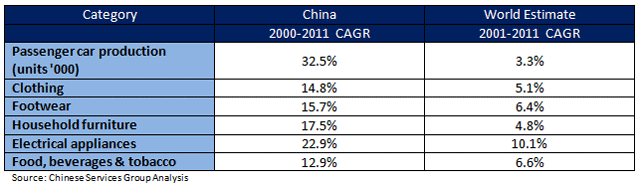

It is not surprising that given substantial slowdown in Europe, China's economic performance continues to disappoint expectations for a rebound. The European Union is China's largest export market. China's exports to Europe were up only 3.2 percent in May while exports to the United States were up 23 percent. Despite this scenario, China´s central government has emphasized the country will meet this year´s economic target and will continue to take measures to stimulate domestic consumption.

|

|

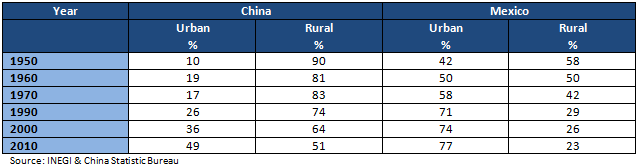

While it would take time to restore international investors' confidence and global economic growth it is important to foresee opportunities coming from potential growth from an emerging economy like China. China's urbanization rate is still below the global average and the country plans to achieve a 67% rate by 2030 - shifting more than 200 million people to cities within two decades.

Information about China is abundant in almost every language, however to this day companies are frequently challenged by the black box of misinformation around China´s economic data. Therefore we are frequently asked:

- Where are the consumers for international brands in China?

- Should my company have a China based sales representative?

- What are the most common mistakes companies make when tapping into China?

- Are we arriving late to Chinese market?

Where are the consumers for international brands in China?

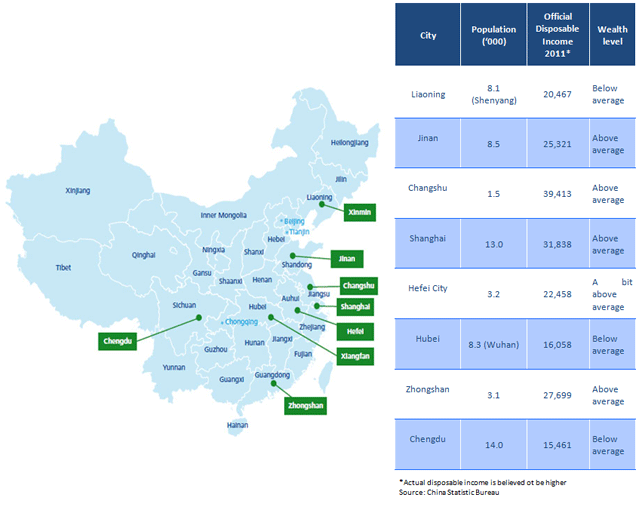

Among some of the factors considered as having complicated the market entry of foreign brands into China has being the perceptions of the vastness and complexity of its domestic market. Although the benefits of globalization have been unevenly distributed among Chinese cities it's possible to segment its domestic market by administrative divisions:

- Tier one. Four cities which include Beijing, Shanghai, Guangzhou and Shenzhen. Recognized in terms of economic development, population, and overall infrastructure, etc.

- Tier two. Thirty four cities which represents provincial capitals where governments are located and usually facilitated with best logistics, and education infrastructure. To this tier belong sub-provincial cities which are the largest prefecture levels and given more autonomy economically.

- Tier three. More than two hundred prefecture cities administrated under provincial government.

- Tier fourth. More than three hundred cities at county level.

Should my company have a China based sales representative?

In general terms in second and third tier cities consumers are more willing to try new premium products which are good news for brands not yet in the market. However, Chinese consumers have unclear perceptions about many brands and products which represent challenges for new comers. Hence in this situation, establishing a China based sales representative becomes critical to educate clients and detect new market opportunities. Foreign companies to often rely on local partners with little knowledge on their product and lack of interest (financially motivated) on growing the brand.

What are the most common mistakes companies make when tapping into China?

For many companies entering to the Chinese market becomes an expensive experience due to four major factors:

a) Misinformation on regulations

Although generic information is good enough to gain an initial overview on regulations companies will have to comply with, still is important to meet with advisors to discuss differences between the law on the books and law in practice. Like in any other market in the world everyone owns their own true.

b) Finding suitable partners

Foreign companies new to China give for granted local representatives reach nationwide distribution channels. Due to the size of the market, unreliable market statistics and fragmented distribution channels, companies need to engage in comprehensive on-ground due diligence to monitor products but also to investigate the suitability of a potential business partner. Ten million population cities like Beijing and Shanghai have no less than fifty companies claiming to be the only ones covering all major retailers and representing leading brands, too often companies discover the opposite and often too late.

c) Cultural differences, what is true and what is not

"You don't understand my country", a phrase often executives hear while confronted in taking quick decisions. Shall my company must pay hóngbāo 红包? At what extents gifts are considered a business protocol to develop a relationship?

d) Retaining and developing talent

Although companies tend to bring managers with international exposure, landing in China usually requires a few years of adaptation, especially if the executive doesn't speak the language nor is knowledgeable to Chinese business protocol. Moreover growing local talent usually is challenged by fierce competition in the market, the reason is simple no other country in the world has as many companies entering their market annually as China.

Are we arriving late to China?

While the answer will depend to specific industries and companies China is going under a process of industry consolidation, strong commitment to improve industry efficiency and shifting from an export oriented economy to a domestic driven one. This scenario will continue to shape and bring opportunities to those whom foreseeing them.

Whether you are trying to enter to China for the first time or planning further geographical growth in China, our Chinese Services Group can help you to make sure that all your business needs are ready to make the most of your strategy. We can help you with your market entry strategy as well as tax compliance needs.

For further information on our services email us at:

gogomez@deloittemx.com, jenciso@deloittemx.com and davidchen@deloittemx.com. |

| |

| |

|

|

|

|

| |

|

|

|

David C. Chen

CSG Mexico Director

Deloitte Mexico |

|

José Luis Enciso

CSG Mexico Manager

Deloitte Mexico |

Gonzalo Gómez

CSG Mexico

Deloitte Mexico |

Back to top |

Taking the helm of business in China

Global Economic Outlook - Q3 2012

The Summer Lull

Deloitte Research's Global Economic Outlook offers timely insights from Deloitte Research's team of economists about the trends and events that are shaping the marketplace. This edition offers economic outlooks for the Eurozone, the United States, China, the United Kingdom, Japan, India, Russia, and Brazil.

If you would like to be alerted when new issues of the Global Economic Outlook are published, you may also subscribe to receive new issues straight into your inbox.

The Global Economic Outlook report is published quarterly by Deloitte Research in the United States (part of Deloitte Services LP).

Download PDF in English Download PDF in English

|

|

| |

Procurement fraud and corruption Sourcing from Asia / 采購欺詐與腐敗 - 防患於未然

With the number of companies using suppliers based in Asia growing, instances of fraud and corruption in the procurement cycle are increasing. While cost savings can be attractive, the financial risks can be bigger and a company's reputation and brands may be put at stake. What companies may not realize is managing procurement fraud and corruption risks in Asia may require a distinctly.

Download PDF in English Download PDF in English

Download PDF in Chinese Download PDF in Chinese

More information online: www.deloitte.com

|

|

|

Hong Kong IPO Market. Interim Review and Outlook - 2012 /

香港IPO市场 2012年中期回顾与展望

In the first half of 2012, Hong Kong's IPO market was hit by global economic uncertainties and saw the most lackluster interim performance since the financial crisis in 2009, raising a total fund of HK$30.6 billion from 32 IPO deals, down 80% from HK$187.2 billion for the same period last year, according to the latest research data from the Public Offering Group of Deloitte China.

During the first six months, over 15 IPOs were believed to have been put on hold, an all-time record high. Expecting that the market condition may ameliorate and several IPO backlogs may be re-launched, we anticipated a better performance for Hong Kong's IPO market in the second half of 2012.

Download PDF in English Download PDF in English

Download PDF in Chinese Download PDF in Chinese

More information online: www.deloitte.com

|

|

|

China VAT Reform - Timetable for expanded VAT reform pilot announced

The China's State Council recently announced that the VAT reform pilot program in Shanghai will be expanded to eight provinces/cities.

The Ministry of Finance and the State Administration of Taxation now jointly issued a circular on 31 July 2012 (Circular 71

(Caishui (2012) No. 71)) that formally sets out the timetable for, and scope of, the expanded

program. According to Circular 71, the expanded program will be phased in between September and

December 2012, as follows:

- Beijing – 1 September;

- Jiangsu and Anhui – 1 October;

- Fujian (including Xiamen) and Guangdong (including Shenzhen) – 1 November; and

- Tianjin, Zhejiang (including Ningbo) and Hubei – 1 December

Download PDF in English Download PDF in English

More information online: www.deloitte.com

|

|

|

China Mergers & Acquisitions Playbook

Your reference guide to planning and executing deals

- 2011 edition

The five years since Deloitte first launched its China M&A Playbook in 2006 have certainly been momentous. Few then, would have been able to forecast both the near-collapse of the global economy and the increasing presence China would come to play on the world-stage. Nonetheless, this is precisely what has occurred and the country's M&A markets have surged as a result, with inbound investments into China over the past four quarters (H2 2010-H1 2011) remaining consistent with deal volumes at the height of the 2007 buyout boom, and outbound acquisitions more than doubling over the same two periods.

However, deal-making in today's volatile climate is anything but easy, with potential bidders having to prepare thoroughly as well as utilize prior deal-making experience where they can, in order to overcome the many obstacles that impinge on a satisfactory deal outcome. With this in mind, Deloitte has produced a China M&A playbook which will serve to enlighten and illuminate its readers on doing a deal in China.

Download PDF in English Download PDF in English

More information online: www.deloitte.com

|

|

|

China M&A Round-up, 09-21-2012

Tracking the trends… one deal at a time

Please see attached the latest Deloitte China M&A weekly for your information.

These are among the transactions announced between

September 14th – September 21st, 2012.

- CCB is eyeing overseas acquisition

- Cnooc Ltd. has received court approval on its US$15.1 billion proposed acquisition of Nexen Inc., a Canadian energy company

- Legend Holdings is to acquire Confucius Family Liquor

- Shandong Gold is to buy stake in Australia's Focus Minerals

Download PDF in English Download PDF in English

|

|

|

|

China M&A Round-up, 09-14-2012

Please see attached the latest Deloitte China M&A weekly for your information.

These are among the transactions announced between

September 7th, - September 14th, 2012.

- Haier bids to take over Fisher & Paykel

- Alibaba is considering in acquisition of logistics companies

Download PDF in English Download PDF in English

|

|

|

|

China M&A Round-up, 09-07-2012

Please see attached the latest Deloitte China M&A weekly for your information.

These are among the transactions announced between

August 31st - September 7, 2012.

- China's Cubbie bid gets approved

- China's Lenovo is to buy Brazilian electronics firm CCE

- Tech Mahindra acquires Hutchison Whampoa's India call center

Download PDF in English Download PDF in English

|

|

Publications

Check out the latest business updates for China / Mexico

|

Asia Pacific Economic Outlook — July 2012

The July 2012 edition of the Asia Pacific Economic Outlook gives a near-term outlook for China, India, Singapore, and Thailand.

China: Economic performance in China is disappointing business leaders, consumers, and even economists who were hoping for a rebound. A substantial slowdown in Europe—China's largest export market—and the uncertainty surrounding the future of the Eurozone is looming heavily on China's economic outlook. Furthermore, loosening monetary policy is failing to produce positive results.

India: GDP growth is likely to moderate in the coming quarters, and growth forecasts for the 2012–2013 fiscal year range between 6.0 and 6.5 percent. The country's fiscal deficit, its current account deficit, a weakening rupee, and feeble growth in the agricultural sector are contributing to the country's economic slowdown.

Singapore: Singapore's economy is likely to perform better in the second quarter of 2012, but growth for the entire year is expected to decline. The prospects for the economy hinge precariously on the turn of events in the global economy. If Europe's debt crisis escalates, Singapore may experience a severe credit crunch, and growth projections may be lowered considerably.

Thailand: Led by a strong performance in the services sector, the economy made a strong comeback in the first quarter of 2012 after contracting nearly 9 percent in Q4 2011. While GDP growth is back to positive territory, downside risks persist. Thailand's reliance on export-led growth makes its economy vulnerable to a deteriorating global macroeconomic environment.

To request previous issues of the Asia Pacific Economic Outlook , please email us at: deloitte_contacto@deloittemx.com

Download document in English Download document in English

More information online: www.deloitte.com

|

|

|

|

The China Factor: Doing Business in China

Deloitte's Doing Business In China Guide has been created to help you see the opportunities and address those challenges. As the first foreign accounting firm to establish itself in China, Deloitte is uniquely qualified to aid foreign investors into China. With decades'

worth of experience dealing with all sectors of the Chinese market and a presence in 16 cities, Deloitte is well-positioned to aid its clients, whether they are new investors

taking the first steps, or the executives of extensive operations

looking to expand still further. We hope you find our insights useful and that it will help you to succeed in the world's fastest growing market

Download document in English Download document in English

More information online: www.deloitte.com |

|

Back to top

|

Keeping pace

| Keep up to date about China´s business environment through our online tools and events: |

| |

Upcoming Webcasts

Transfer Pricing

Strategic Transfer Pricing: A Framework for Effective Planning and Compliance

October 16, 2:00 – 3:00 PM HKT (GMT +8)

Host: Shanto Ghosh

Presenters: Tae Hyung Kim, Tim O'Brien, and Steve Towers

As more multinational companies operate according to globally integrated business models, issues can arise with respect to their intercompany transaction pricing. Continually evolving transfer pricing tax laws complicate matters, demanding tighter integration of a company's transfer pricing and international tax planning, and compliance functions. We'll discuss:

- A framework to develop a transfer pricing strategy for global companies, which integrates transfer pricing with international tax planning

- Ways to identify transfer pricing risks within the globally integrated business model

- Aligning transfer pricing policies with your company's global business objectives

Understand why transfer pricing has become a critical international tax issue for multinational companies, and explore ways to align your transfer pricing activities with your organization's strategic objectives.

Register to webcast Register to webcast

Regulatory

India's M&A Regulatory Landscape: Look before You Leap

October, 18 2:00 – 3:00 PM HKT (GMT +8)

Host: Vijay Dhingra

Presenters: Mehul Modi and Sanjeev Shah

With newly revised takeover regulations from the Securities and Exchange Board of India and the combination regime under the country's Competition Act, resounding changes are underway in India's regulatory landscape. Will it take longer to consummate future M&A transactions and could accidental omissions in the process lead to significant fines? We'll discuss:

- An overview of the new regulations, including potential triggers and exemptions

- Changes that the new regulations impose across the end-to-end M&A process

- Potential fines and penalties in cases of omission

- Significant case studies already emerging under the new rules

Learn about possible regulatory implications for proposed M&A transactions in light of the new regulations and how such transactions can be structured within the new regulatory requirements going forward.

Register to webcast Register to webcast

International Tax

Draft Amendments to the OECD Commentary on the Definition of "Permanent Establishment" in Article 5: What are the Big Issues under Discussion?

October, 25 2:00 – 3:00 PM HKT (GMT +8)

Host: Steve Towers

Presenters: Claudio Cimetta, C.A. Gupta, and Leonard Khaw

The OECD is continuing its work on amending the Commentary on the "permanent establishment" definition in Article 5 of the OECD model treaty. During an OECD consultation with private sector representatives in September 2012, a number of significant issues emerged. We'll discuss:

- The "at the disposal" test in Article 5(1), including statements seeking to identify the ambit of the test, the application of the test to companies which store customers' goods (e.g., toll manufacturers, logistics companies), and to situations where there is extensive sub-contracting

- The application of Article 5(1) to secondments of employees and the relationship between Article 5(1) and Article 5(3)

- The "time" requirement under Article 5(1): is 6 months a "rule"?

- Issues concerning the "agency PE" in Article 5(5), including the meaning of "binding" (i.e., legally or economically?), the relationship between Article 5(5) and Article 5(6) (i.e., is Article 5(6) merely an exception to Article 5(5) or something more?), and the application of Article 5(6) to fund managers

Find out about the latest OECD thinking in regard to these significant amendments to the OECD Commentary.

Register to webcast Register to webcast

税务

中国合伙企业︰即将可行或成为优选的商业形式?

11月1日上午11时-下午12时 (香港/北京时间, GMT +8)

主持人︰王鲲

主讲人︰叶红、张博及蒋俊

期待已久的中国合伙企业税收规则即将定案。

中国合伙企业这种商业形式能否因此成为在华投资的一种优选?我们将讨论︰

- 进入中国的投资者通常如何使用每种商业形式,

以及税收在投资者决定使用何种商业形式时所扮演的角色。

- 中国合伙企业作为一种商业形式的概述以及其预期的税收属性。

- 可能影响中国合伙企业税收规则的有关政策因素。

探索影响中国合伙企业新税收规则定案的动态,

并了解在哪些情况下中国合伙企业可能成为在华投资或从事业务的优选商业形式。

注册参加此网络讲座 注册参加此网络讲座

(请收听于11月15日下午2时-3时播放的相关英语讲座。详情请访问

Asia Pacific Tax – China Spotlight网页 。) |

|

Back to top |

We hope this information is useful to you and your organization, as we strive to continue offering high value information.

If you are not yet registered to receive this monthly newsletter, please click here:

Learn more at: http://www.deloitte.com/mx/mexicoandchina |