|

The China Factor

Mexico and the BRICS: the next wave of partnerships, competition and operating models? |

30th Edition

Dear Clients & Friends:

The economic turmoil continues, there has not been a huge recovery yet. As usual, there are fluctuations around the world, for instance, as Carl D. Hughes, Global Head, Energy & Resources from Deloitte mentions:

"the rising global commodity prices – which are due in part to rapidly-growing Chinese demand –have fed into industry´s costs in China. China´s voracious appetite for all classes of raw materials has force mining commodity prices upward, leading to generally improved profits at mining companies but potentially setting the stage for a future pricing correction" (Energy & Resources Predictions 2012, p. 1).

The world population it´s growing, and natural resources are becoming scarce, that´s why China, it´s one of the main consumer parties interested searching for natural resources and food around the world, Latin America it´s just one of the options.

We invite to read the complete report Energy & Resources Predictions 2012, about the oil industry, natural gas, nanotechnologies, energy storage, among others.

Additionally, we invite to review this month's editorial: Mexico and the BRICS: the next wave of partnerships, competition and operating models?. Also, to review the M&A section and the brief tax flash: Hong Kong Tax Transfer Pricing Services.

This first quarter of 2012, Deloitte participated in Mexico City in the Expo Mexico-China Investment & Trade Forum, 2012 and in the Boao Forum for Asia Annual Conference 2012.

At Deloitte, we continue with our objective of sharing business information to help you identify opportunities and feedback for doing business in Mexico and China.

Chinese Services Group

Deloitte Mexico

Versión en español Versión en español

In this edition:

Editorial comment

Mexico and the BRICS: the next wave of partnerships, competition and operating models? Mexico and the BRICS: the next wave of partnerships, competition and operating models?

Taking the helm of business in China

Riding the dragon. Will Asia mid-market M&A prosper? Riding the dragon. Will Asia mid-market M&A prosper?

China M&A Round-up, 04-06-2012 China M&A Round-up, 04-06-2012

China M&A Round-up, 03-30-2012 China M&A Round-up, 03-30-2012

Hong Kong Tax Transfer Pricing Services - 香港税务 转让定价服务 Hong Kong Tax Transfer Pricing Services - 香港税务 转让定价服务

Publications

Energy & Resources Predictions 2012 Energy & Resources Predictions 2012

Deloitte launches top 10 trends & prospects of the Chinese banking industry in 2012 Deloitte launches top 10 trends & prospects of the Chinese banking industry in 2012

Fortresses and footholds - Emerging market growth strategies, practices and outlook Fortresses and footholds - Emerging market growth strategies, practices and outlook

Lateral trades - Breathing fire into the BRICS Lateral trades - Breathing fire into the BRICS

Keeping pace

Expo Mexico-China Investment & Trade Forum, 2012 Expo Mexico-China Investment & Trade Forum, 2012

Boao Forum for Asia Annual Conference 2012 Boao Forum for Asia Annual Conference 2012

Webcasts

Asia Pacific Webcast: 普通話網絡講座 – Chinese Language Webcasts Asia Pacific Webcast: 普通話網絡講座 – Chinese Language Webcasts

|

Deloitte China mobile app: Get connected to our collective knowledge

and fresh insights on today's

complex market and business issues

while you are on the go. Click here to download. |

Editorial comment

Mexico and the BRICS: the next wave of partnerships,

competition and operating models?

"With an average estimated GDP growth rate at 4.8 percent over the coming 12 months, according to the International Monetary Fund (IMF) – a figure that is four times larger than their developed market counterparts´- the global spotlight is almost undoubtedly going to remain on the BRICS economies (made up of Brazil, Russia, India, China and South Africa) over the foreseeable future.

|

|

Driven by favorable demographics, a rapidly-expanding middle class, as well as being characterized by relative political stability and bullish investor sentiment, cross border M&A activity between BRICS will continue to shine bright despite a less positive outlook elsewhere", according to our latest report Lateral trades. Breathing fire into the BRICS. The five economies now account for roughly one-third of the world´s total population and a combined nominal GDP of US$13.6 trillion.

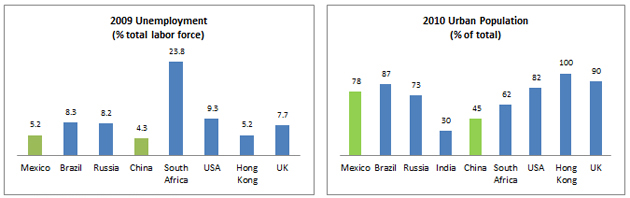

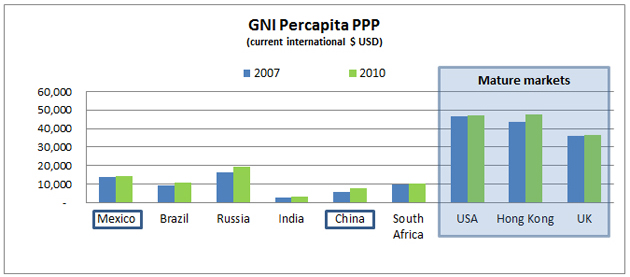

To further understand this ongoing trend bellow some key indicators that overall indicates there is room for growth.

Source: World Bank. http//data.worldbank.org/ Source: World Bank. http//data.worldbank.org/

Source: World Bank. http//data.worldbank.org/

While financial inestability in 2008 affected every corner in the world, Mexico and China (altought affected too) maintained a lower unemployment rate compared with developed economies like the USA and UK. On the other hand altought China is predominantly a rural country, figures indicates that urbanisation will continue in the years ahead. This will continue representing both significant challenges and opportunities for policy makers and executives in China managing companies to grow within a highly fragmented and ever evolving market.

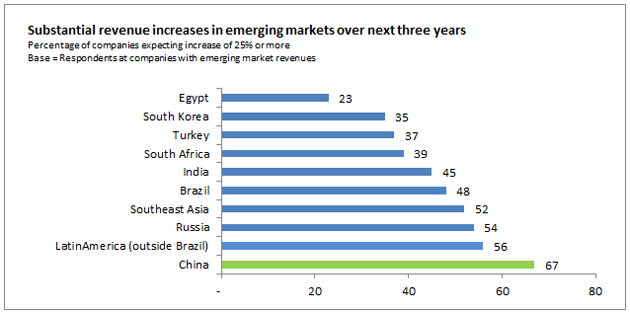

Source: In mid-2011, Deloitte Consulting LLP conducted a survey (Fortresses and footholds. Emerging market growth strategies, practices and outlook) of 628 executives to understand where they perceived the greatest revenue opportunities in emerging markets.

The survey results indicated that companies active in emerging markets anticipate revenue increases of 25 percent or greater over the next three years: in three locations: India (57 percent), China (56 percent), and Brazil (49 percent). In Latin America (outside Brazil), executives saw the greatest opportunities in Mexico (56 percent), Argentina (44 percent), and Chile (36 percent). Among manufacturers, 81 percent cited Mexico as providing revenue opportunities. Sixty four percent of consumer product manufacturers also saw opportunity in Mexico.

Emerging markets not only have a rising number of potential consumers they are becoming home of a new generation of international companies with a unique set of characteristics and operating models. Under this scenario, Mexican and Chinese firms will have to understand each other better as market forces are bringing them closer than ever. Mexico is to North America as China´s is to the Asian market, both of them represent preferred destinations to set up regional manufacturing centers.

Forging partnerships between Mexican and Chinese firms will imply organizational learning and greater openness to cross-cultural sensitiveness to successfully build a long standing relationship. Local expertise provides endless advantages such as greater knowledge of customer habits, brand awareness in the market and more experience in managing relationships with local stakeholders.

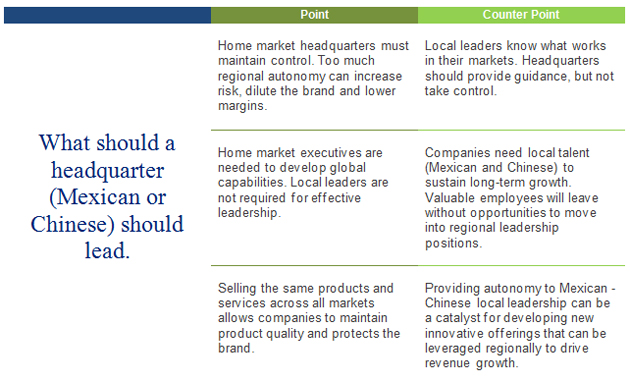

Companies from both countries before choosing a specific strategy to grow either organically or seeking a joint venture partner shall consider whether headquarters or country branches should lead growth.

Source: Adaptation from David N. Martin, U.S. Emerging Market Growth Strategies Leader, Principal, Deloitte Consulting LLP.

Perhaps it is time to consider two new proverbs in our business vocabulary: 入中随俗(When in China do as Chinese do) and 入墨随俗 (When in Mexico do as Mexicans do).

Contact us to find out how we can help you.

For more information on our services email us at: deloitte_contacto@deloittemx.com |

| |

| |

|

|

|

|

| |

|

|

|

David C. Chen

CSG Mexico Director

Deloitte Mexico |

|

José Luis Enciso

CSG Mexico Manager

Deloitte Mexico |

|

Back to top |

Taking the helm of business in China

Riding the dragon. Will Asia mid-market M&A prosper?

Asia Pacific mid-market M&A roundup – 2012 edition

Executive Summary

The Asia-Pacific region arguably encompasses the world´s most diverse group of economies, ranging from the sophisticated and mature markets of Australia and Japan to the Asian tigers of South Korea, Hong Kong, Singapore and Taiwan; the centrally-planned yet high-growth nations of China and Vietnam; and finally, the colorful but questionably the most dynamic economies of all – India, Indonesia and even former pariah state like Myanmar, all of which harbor huge amounts of untapped potential.

Download PDF in English Download PDF in English

|

|

|

China M&A Round-up, 04-06-2012

Tracking the trends… one deal at a time

Please see attached the latest Deloitte China M&A weekly for your information. These are among the transactions announced between March 30, 2012 - April 6, 2012.

- Chalco is to buy SouthGobi's majority stake.

- Sinopec completes deal with Galp Energia's Brazil assets.

- China's Zijin Mining offers to buy Norton Gold Fields.

Download PDF in English Download PDF in English

|

|

|

|

China M&A Round-up, 03-30-2012

Please see attached the latest Deloitte China M&A weekly for your information. These are among the transactions announced between March 23, 2012 - March 30, 2012.

- CNNC is in talks with Areva on uranium stakes.

- China Coal acquires coal mining business.

Download PDF in English Download PDF in English

|

|

|

|

Hong Kong Advance Pricing Arrangement Program

The release of the Departmental Interpretation and Practice Notes No. 48 ("DIPN 48") by the Hong Kong Inland Revenue Department on 29 March 2012 has marked the launch of the Advance Pricing Arrangement ("APA") program in Hong Kong which is to be officially rolled out on 2 April 2012.

Download PDF in English Download PDF in English

Download PDF in Chinese Download PDF in Chinese

|

|

Publications

Check out the latest business updates for China / Mexico

|

Energy & Resources Predictions 2012

This is the third year in which we have published our predictions for the year ahead.

Over the last 12 months, there has been no shortage of themes impacting energy and resources globally. These themes are diverse as they are geographically dispersed.

Rather than focusing on the predictions themselves, companies and their management teams should consider the underlying issues that makeup these predictions and how they might help to formulate future strategy. These issues should stimulate debate, inform possible options and may even help identify potential courses of action.

Download document in English Download document in English

More information: www.deloitte.com

|

|

|

|

Deloitte launches top 10 trends & prospects of the Chinese banking industry in 2012

Banking sector needs to enhance capital management to meet new challenges

Despite risks of decreasing growth and economic hard landing, the Chinese banking sector continued to report remarkable profits and maintained high growth in 2011, according to Deloitte's report on the Top 10 trends & prospects of the Chinese banking industry in 2012.

At the same time, Chinese banks should be aware of the potential risks and implications brought by other international and domestic uncertainties, such as the deteriorating European debt crisis and pressure from local financing platforms and real estate loans on their asset quality.

Download document in Traditional Chinese Download document in Traditional Chinese

More information: www.deloitte.com |

|

|

|

Fortresses and footholds - Emerging market growth strategies, practices and outlook

At a time when most developed economies are still struggling to fully recover from the 2008 global financial crisis, China, India, Brazil, and other emerging markets are projected to account for a majority of the growth in global gross domestic product (GDP) over the next several years. While multinational companies have historically used emerging markets primarily to reduce costs, organizations are increasingly looking to these markets as a platform for revenue growth through 2014 and beyond.

Download document in English Download document in English

More information: www.deloitte.com |

|

|

|

Lateral trades - Breathing fire into the BRICS

With an average estimated GDP growth rate of 4.8 percent over the coming 12 months, according to the International Monetary Fund (IMF) - a figure that is four times larger than their developed market counterparts' - the global spotlight is almost undoubtedly going to remain on the BRICS economies (made up of Brazil, Russia, India, China and South Africa) over the forseeable future.

Download document in English Download document in English

More information: www.deloitte.com |

|

Back to top

|

Keeping pace

| Keep up to date about China´s business environment through our online tools and events: |

| |

Expo Mexico-China Investment & Trade Forum, 2012

Currently, China it´s the leading development country due to its high growth rate and international trade capacity. Chinese companies have been established in Mexico through subsidiaries or strategic alliances, searching for an additional market to positionante its products at a competitive price.

In response to this business dynamic, Deloitte participated as sponsor of Mexico China Investment & Trade Forum, from March 21st -23rd, in the Expo Bancomer Building, in Mexico City. There were approximately 2000 visitors in the event, from both Mexican and Chinese companies.

Visit the Expo´s website Visit the Expo´s website

|

|

|

|

Boao Forum for Asia Annual Conference 2012

Asia in the changing world: Moving towards sound and sustainable development

Deloitte is proud to be the Intellectual Supporting Partner for the 7th consecutive year for the Boao Forum for Asia Annual Conference (BFA AC) under the theme "Asia in the changing world: Moving towards sound and sustainable development", event that took place from March 31st to 3 April 2012 in Boao, Hainan, China.

Deloitte participated with a senior delegation of partners led by Global Deputy CEO, Brian Derksen, Chairman of Deloitte Center for Cross-Border Investment & Former Deputy Secretary of the Treasury, USA, Robert Kimmitt, Asia Pacific CEO Chaly Mah, China Chairman Joseph Lo and China CEO Chris Lu to discuss with other business leaders, politicians and intellectuals on topics related to maintaining a stable environment and promoting continuous development in Asia amid economic uncertainty arising from international debt crises

More information: www.deloitte.com |

|

|

|

Asia Pacific Dbriefs

Anticipating tomorrow's complex issues and new strategies is a challenge. Stay fresh with Dbriefs – live webcasts that give you valuable insights on important developments affecting your business in Asia Pacific.

Watch the video online Watch the video online

|

|

|

|

Asia Pacific Webcasts

Archived Webcasts

Webcasts archived in the last month can be accessed online. For a complete program schedule and topic information on upcoming webcasts, select the Program Guide by clicking on this link.

Upcoming Webcasts

International Tax

Cash Pooling in Asia Pacific: Tax Issues

17 April, 2:00 – 3:00 PM HKT (GMT+8)

Host: Steve Towers

Presenters: Troy Andrews, Patrick Broughan, Leonard Khaw, and Roderik Vehmeijer

Cash pooling is gaining popularity in Asia Pacific as a technique for multinational companies to effectively manage their cash. But what tax challenges exist? We'll discuss:

- Different cash pooling structures which are frequently seen in Asia Pacific, and the reasons for the variations.

- Tax issues such as interest taxation and deductibility, thin capitalization rules, withholding tax, parent company CFC rules, foreign tax credits, and transfer pricing.

- Factors to consider in the selection of the location of the "header" entity, including tax incentives and access to a favorable treaty network.

Learn about the important tax issues which relate to cash pooling in Asia Pacific.

Register to webcast Register to webcast

Tax Management

Tax Risk Management: A Legislative Review of Key Asia Pacific

Countries and Industries

10 May, 4:00 – 5:00 PM HKT (GMT+8)

Host: Eddy Hartman

Presenters: Robbert Hoyng, Chris Roberge, and Nick Walters

Tax authorities around the globe are increasingly shifting their focus from traditional audits to tax risk management processes. But which requirements around tax risk management and tax policy are mandatory? What are the common themes across the board, and what are specific issues for financial services and energy and resource businesses? We'll discuss:

- An overview of accounting standards and tax legislation in the Asia Pacific region and key investment countries, including Australia, China, India, Japan, Korea, the UK, and the U.S.

- Tax risk management policy considerations – should you take a global or regional approach?

- Specific considerations for addressing tax risks in the financial services and energy and resources industries, including the risks related to acquisition of assets overseas as well as managing the tax function in multiple countries.

Learn about emerging tax risk management requirements are and how companies are responding.

Register to webcast Register to webcast

International Tax

Asia Pacific Holding Companies: Issues, Challenges, and Opportunities

15 May, 2:00 – 3:00 PM HKT (GMT+8)

Host: Steve Towers

Presenters: Leonard Khaw, Rohit Shah, and Davy Yun

The design and location of holding company structures in the Asia Pacific region continue to be impacted by legislative and treaty changes and tax authority challenges. What approaches may help you address these issues? We'll discuss:

- Possible double tax treaty benefits in respect of dividends and share sales – which treaty is best in class for each source country?

- Substance requirements imposed by source countries, such as China and Korea, and why naked holding companies are dead.

- Potential benefits of locating holding companies in Singapore vs Hong Kong vs other countries, including low tax rates and exemptions for dividends, offshore income, and capital gains.

- Source country taxation of indirect transfers.

Learn the latest thinking about this very important area of Asia Pacific taxation.

Register to webcast Register to webcast

More information online: www.deloitte.com |

|

|

|

Deloitte China mobile app

Get connected to our collective knowledge and fresh insights on today's complex market and business issues while you are on the go.

The Deloitte China mobile application can now be downloaded for free for iPad and iPhone in the Apple iTunes store or the App Store through your mobile device by searching for deloitte china.

Upon downloading the app, you will be granted access to browse through our thought-provoking and in-depth analyses, surveys, reports and publications by service area and by industry. All publications are downloadable to your library for easy access in the future.

More information online: www.deloitte.com |

|

Back to top |

We hope this information is useful to you and your organization, as we strive to continue offering high value information.

If you are not yet registered to receive this monthly newsletter, please click here:

Learn more at: http://www.deloitte.com/mx/mexicoandchina |